Regression of Progressive Taxation

1980 Reagan’s Gutting → 2012 Obama’s Partial Restoration

This article traces the modern history of progressive taxation from 1980’s onwards. For what went before, check out A Brief History of Progressive Taxation.

From the 1950s until 1980 (the Reagan era), the US tax system was the most equitable it has ever been. Those who had the most to gain paid the most taxes. For details check out the following table.

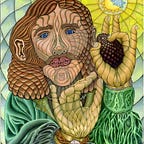

Milton Friedman (1912–2006): Negative Income Tax

In the 1960s, a prominent economist began questioning some of the Keynesian theories that had driven government policy for the previous quarter century. His name was Milton Friedman. Friedman was a leading member of the Chicago school of economics and its most well known member. He is considered to be second in importance to Keynes in terms of political influence in the 20th century. While Keynes laid the foundations for the middle of the century, Friedman’s refinements dominated government policy during the final quarter of the century.

Friedman was in agreement with Keynes on many key issues. In similar fashion to Keynes, Friedman believed that controlling interest rates was a valuable tool in tempering the fluctuations of the business cycle. Both viewed raising interest rates as an important method for combating inflation. A hike in interest rates typically would slow business activity and reduce inflationary pressure. Conversely, lowering interest rates was viewed as a method to stimulate business investment.

Like Keynes, Friedman respected the importance of the consumer as the key to a healthy economy. However as a laissez faire economist, Friedman rejected what he called ‘naïve Keynesian economics’. For instance, in contrast to Keynes, Friedman’s theory held that full employment was impossible. According to his economic philosophy, there is a ‘natural’ unemployment rate (somewhere in the single digits). Government action that attempted to reduce it beyond this ‘natural’ threshold would only aggravate unemployment and imbalance the economy. Virtually no government questions this analysis in current times. It seems that unemployment is a necessary feature of a capitalist system, and in this sense Keynes was unrealistic or naïve.

While Keynes may have been unrealistic about the goal of zero unemployment, governments continue to utilize many of his other central economic principles to this day. Friedman’s critique of Keynes addresses some of these contemporary economic policies. While Keynes relied on government programs to play a significant role in protecting consumer demand, Friedman felt this could be accomplished by reducing government’s active role. This included the deregulation of business and the elimination of social programs for the needy.

Adhering to the fundamental Keynesian notion that the consumer was the key to a strong economy, Friedman advocated an approach that replaced the expanding role of federal government programs with a negative income tax. A negative income tax is another name for a guaranteed annual income. Rather than relying on specific federal programs, Friedman theorized that every citizen should at least be guaranteed a predetermined minimum income. If a citizen’s income fell below a certain threshold, the government should fund the difference with revenues raised from a progressive tax system.

While Keynes advocated government intervention through specific programs to assist the less fortunate, Friedman advocated direct, automatic funding. Friedman’s preset, almost mechanical, system would eliminate the centralized, bureaucratized social welfare services. Providing a guaranteed minimum income to every citizen could be a more efficient way to support consumer spending without creating social programs supported by burgeoning government bureaucracies.

Both Keynes and Friedman believed in the importance of employment to consumer spending. Keynes theorized that the public sector should supplement the private sector by providing jobs for the able-bodied that would otherwise be unemployed. Friedman’s analysis suggested that the private sector would accomplish the same task more efficiently.

As a monetarist, Friedman argued that it was not government policy that drove the business cycle, but rather the previously mentioned interest rate adjustments combined with a new appreciation for the importance of money supply. Rather than creating public jobs, government should increase the money supply available to banks. The banks can then lend this money to the private business community in order to create jobs.

Many economic conservatives misinterpret Friedman’s position as a return to a pure form of laissez faire capitalism. Neither Friedman nor Keynes trusted the free market to be able to resolve major economic fluctuations on its own. Both agreed that the government needed to act as an intermediary between free market capitalism and the welfare of the citizenry. Both argued that the government would need to make interest rate adjustments. Friedman went further to suggest that the government should also act to adjust the money supply.

Friedman is also often misunderstood as an economist who advocated eliminating government support for the financially challenged members of US society. While Keynes argued for the creation of government programs that targeted groups of needy citizens, Friedman argued for a different type of government action. Friedman’s ‘negative income tax’ was designed to enable these challenged individuals to remain actively consuming, even if at a reduced rate. Friedman wanted to replace government bureaucracy with automatic payments, not eliminate social assistance to the needy.

Friedman understood that his negative income tax approach required federal funding. His solution called for the utilization of progressive taxation. He realized, as did Presidents Lincoln, Wilson, and Roosevelt, that only the upper income brackets possessed adequate resources to meet these challenging economic needs. In this sense, Friedman believed in progressive taxation as a means of redistributing wealth from higher to lower income individuals in order to protect the consumer base and thereby the overall American economy.

It would be wrong to characterize Friedman as opposing a government role in combating the excesses of laissez faire capitalism. It would also be inaccurate to portray him as a foe of government assistance in support of an endangered consumer base. And finally it would be disingenuous to somehow claim that Friedman was an enemy of pre-Reagan Era progressive taxation. And yet conservative economists often misconstrue Friedman’s philosophy to take the opposite of these 3 well-documented positions.

According to Friedman’s analysis, Keynesian economics worked perfectly during times of growth and inflation. This was the global situation for almost 40 years, from the end of World War II until the 1970s. However, he predicted that Keynesian economics would be unsuccessful during a time of inflation combined with recession. Lending credence to Friedman’s theories, the nation entered such a period, shortly after he became a Nobel Laureate in 1976.

Modern History: Reaganomics guts Progressivity of US Tax System

In the late 1970s, the global economy entered a period deemed ‘stagflation’. Even though the economy was ‘stagnant’ with high unemployment rates, inflation was raging out of control. Both were in double digits. Typically high unemployment is not accompanied by high inflation rates. What led to this unusual state of affairs? And what effect did this state of affairs have on government economic policy?

The Middle Eastern oil producers joined together to form a cartel, known to the world as OPEC. The ultimate effects of this cartel led to (at one time) politically motivated oil embargos on Western Europe and the United States, and in general dramatically increased global petroleum prices. For instance, the price of gasoline tripled from 33 cents to over a dollar per gallon between 1973 and 1974.

The tripling of energy costs had an adverse effect upon the price structure of an essentially petroleum-based economy. The dramatic increase in cost of energy led to a corresponding increase in the prices of nearly all basic commodities, including food. With the price of necessities skyrocketing, many workers demanded and were granted raises, which further aggravated inflation rates. Unable to handle the economic stress of increasing energy and labor costs, many businesses went under, which led to unacceptably high unemployment rates.

As Friedman predicted, the Keynesian approach seemed unable to deal with this unique economic situation. Neither adjusting interest rates nor increasing government spending seemed to be feasible options for policy makers given the simultaneous threats of inflation and unemployment. Events appeared to call for a different economic theory.

As a consequence, the theories of Friedman’s monetarist school came to be given increased consideration. Monetarists argued that government could address the stagnation of rising unemployment by increasing the money supply, rather than increasing direct government spending. Providing additional funds to the private sector would enable the economy to right itself naturally without risking the perceived inflationary pressures associated with the expansion of government programs. Due to the purported success of this approach in dealing with the unique problem of stagflation, the importance of monetary policy began to rise as a dominant economic theory.

These stressful times primed the pump for new types of solutions. Further it had been nearly a half-century since the Great Depression. Most had forgotten the original intent of progressive taxation, i.e. to mitigate the disastrous extremes of the ‘boom & bust’ cycle. These taxes came to be viewed in a different light.

During the Depression Era, the ‘social safety net’ consisted primarily of limited assistance for the retired and those who had lost their jobs. In the ensuing decades, the social safety net expanded considerably to include a wide range of government assistance for the needy, including but not limited to education and medical needs. Each of these programs had the effect of transferring government funds that consisted primarily of taxes from those on the top of the income ladder to those on the bottom or middle of the income ladder.

Recall that this redistribution of wealth was at least in part devised to protect Americans from the devastating economic consequences of capitalism’s innate boom-bust cycle. Funding the social safety net via progressive taxation provided funds to create a stronger consumer base that is the foundation of modern capitalism. Further, this form of taxation had the added benefit of constraining funds employed for reckless speculation. While compassion may have played a part, this taxation strategy was devised primarily to prevent serious threats to the social structure due to the increasing severity of global economic oscillations. As evidence for the success of this unique counter-cyclical strategy, the United States never returned to an economic downturn the magnitude of the Great Depression during the subsequent half-century.

Maintaining socio-economic stability was the initial motive behind the creation of the progressive tax system in the 1930s. By 1980, nearly a half-century after the Great Depression, the urgency of the original purpose appears to have been forgotten. The redistribution of wealth was rarely viewed as a financial strategy designed to benefit the entire economic spectrum. Instead government assistance for lower income Americans was increasingly framed as ‘socialist handouts’ funded by excessive taxes on ‘job-creating capitalists’. In other words, the public understanding of the motive behind progressive taxation underwent a perceptual shift from economic stability to altruistic liberalism.

The altruistic interpretation of progressive taxation, whether inadvertent or intentional, led to a not so subtle shift in the values that citizens began to associate with their tax payment. The concern for the general economic welfare that flowed from the experience of the Great Depression was replaced by a concern for the negative impact of taxation upon the individual, the family, and the recipient of governmental aid. It became popular to characterize social assistance as a set of counter-productive measures that actually fostered an unhealthy dependence on government at the expense of self-reliance. This new perspective led to broad-based taxpayer resentment and a corresponding disrespect for the value of a social safety net.

Cries of outrage were heard from all income levels, including the lowest. Common sentiments include(d): “Why should my hard earned money go to taxes that fund a bloated welfare state that takes care of the undeserving?” “Why should workers be asked to provide financial assistance to jobless members of society?” “How is government assistance ever going to result in self-sufficient productive citizens?” Under this mindset, compassion for the needy came to be perceived as a personal sacrifice demanded of the taxpayer, which could be likened to liberalism’s ‘soft love’ that risked spoiling the child.

After hearing this refrain played in myriad variations, a majority of the population came to resent what was and is perceived as ‘excessive taxation’. Under this media barrage, the bulk of the population, inadvertently or intentionally, forgot the original value of the ‘social safety net’ funded by progressive taxation. Conveniently forgotten was the economic wisdom of both protecting the spending power of a broad consumer base and draining off funds employed for reckless speculation.

Like symphony masters, the Republican Party played this rising emotional sentiment against taxes and government ‘handouts’ to persuade the American public to elect Ronald Reagan US president in 1980. One of his major platforms was, of course, tax reform. The Reagan Administration employed Friedman’s economic theories to add academic credence to their fiscal policy. This new approach became known as Reaganomics.

However as we shall see, they were selective in implementing Friedman’s economic philosophy. They chose to follow policies that primarily benefited those with higher incomes. Reaganomics appeared to ignore, or even chose to directly violate, the parts of Friedman’s theories that protected the spending power of lower income Americans.

More specifically, the Reagan/Bush administrations implemented a feature of Friedman’s economic philosophy that called for a reduction in government social programs. These programs, which were designed to assist lower and middle income Americans, were to be replaced in Friedman’s approach by a negative income tax funded by progressive taxation. The Reagan/Bush administrations ignored this important substitute support system for vulnerable Americans, while using Milton Friedman’s theory to enhance the economic credibility of Reaganomics.

Reaganomics also appeared to ignore or even violate Freidman’s principles regarding the importance of progressive taxation. Once elected, the Reagan Administration went right to work eroding the progressivity of the Federal tax system and continued right up until the end of his term. Congress passed legislation in 1981, 1982, 1987 and 1988, that successively reduced the progressivity of the tax system. Let’s examine this erosion in more detail.

The attack was multi-pronged. Tax legislation reduced the rate on the top bracket in a series of stages from 70% to 28% in only 8 years. During the same period, the rate for the bottom bracket rose from 14% to 15%. The tax liability of those who were most able to pay was reduced substantially, while taxes increased for those least able to pay.

They also eroded the progressivity of the tax system by reducing the number of evenly graduated tax brackets from 25 in 1980 to an astounding 2 by 1988. Simultaneously, the threshold of the top tax bracket was reduced from $212K (current equivalent $550K) to $30K ($60K currently). These reductions had a number of significant consequences.

By 1988 the lower middle class wage earner was paying basically the same tax percentage on his income as the multi-millionaire or even billionaire. When those with moderate incomes were required to pay the same tax rate as the extremely wealthy, the traditional standard of ‘ability to pay’ was forsaken. The creation of a Federal Income Tax System presupposed a progressive set of tax brackets designed to spread the tax burden in a just and efficacious manner.

In fact, from 1917 to 1979, the Federal Income Tax had a minimum of 21 brackets with the threshold of the top bracket set at a minimum of one million in current dollars. Traditionally, the top tax brackets were reserved for those citizens who could reasonably be viewed as very wealthy. The history of the Federal Income Tax demonstrates that our conception of tax justice was clearly connected to a set of evenly graduated brackets that reflected a citizen’s ‘ability to pay’. It was accepted for over 60 years that greater wealth indicated a greater ability and hence a greater duty to shoulder a fair share of our society’s tax obligations.

By reducing overall tax rates as well as the number and thresholds of tax brackets, the Reagan Administration successfully eliminated the progressivity of the US tax system. Progressive taxation was replaced with an essentially flat tax for all but those on the lowest rungs of the income ladder.

Adding to this assault on progressivity, the Reagan Administration nearly doubled the percentages of the regressive Social Security Tax, which is primarily levied on working class Americans. (For more, check out the article ‘Are US Taxes really Progressive?’.) The percentage of income paid to Social Security rose from 8.08% in 1980 to 15.3% in 1991. (This percentage includes employee and employer contributions.)

This doubling of Social Security Taxes increased an already regressive system by targeting those workers with the least disposable income and consequently the least ability to pay income taxes. The Reagan Administration effectively shifted a substantial portion of the total tax responsibility from higher income to lower income Americans. In essence, Reaganomics can be viewed as series of actions that resulted in a dramatic redistribution of wealth from our poorest to our richest citizens.

The official reason given by the Reagan Administration for this increase in Social Security tax rates was to save the System from default in the near future. The Media faithfully relayed this justification to the US public. An unspoken, yet obviously pragmatic, reason was the need to generate more tax revenue. Reagan’s ‘tax reform’, while leading to huge tax cuts for the wealthiest Americans, also led to a dramatic shortfall in government revenues. The Reagan Era’s increase in Social Security Taxes was employed in part to compensate for this shortfall in income tax revenues.

By the end of Reagan’s term in office, the progressivity of the US tax system was almost non-existent. The unprecedented reduction in tax rates, particularly for upper income Americans, and the near elimination of all tax brackets severely eroded the progressivity of Federal Income Taxes. Further, an increase in the personal income tax rate and a doubling in the Social Security taxes for most wage-earning Americans increased the overall regressivity of the federal tax system.

Consequences: from Bush Sr. to Obama

Unfortunately, the Reagan and Bush Administrations implemented only one half of Friedman’s solution and violated the other. They deregulated business and slashed government programs. However, they failed to implement a guaranteed annual income that Friedman recommended to compensate for such a severe reduction in federal social programs. In addition, they undermined the progressivity of the tax system, which was intended to fund the federal budget including his proposed negative income tax. This strategy was, in effect, a direct violation of Friedman’s theories.

The strategy employed by the Reagan Administration unbalanced Friedman’s equation. As might be expected, this imbalance led to fairly immediate problems. Due in part to the reduction in tax revenue, the social safety net was eroded. This erosion had a negative impact on the foundation of capitalism — the consumer. Plus, it diminished the ability of the government to generate revenue.

Suffocating for lack of funds, George Bush, Reagan’s successor, reintroduced a bit of progressivity to the system. The Bush Administration introduced a 3rd tax bracket, reorganized the tax bracket thresholds, and raised the tax percentages slightly. Earnings over $82K ($140K currently) were now taxed at a 31% rate. While up from the 28% on income over $30K ($60K currently), it was a far cry from the 70% on income over $212K ($550K currently) that had been levied just a decade prior. It is no wonder that many wealthy Americans recall the Reagan and Bush era in a very favorable light.

But the Bush Administration’s adjustments were too little, too late. The nation entered a serious recession. In 1993, Bill Clinton was elected President in part to solve the problems created by the preceding Republican administrations. To address the revenue shortfall, his Administration slightly raised the level of progressivity in the US tax system. The number of brackets were increased from 3 to 5; the corresponding thresholds were distributed more equitably; and the top tax percentages were increased. Income over $250K ($410K currently) up from $82K ($140K currently) was now taxed at a 39.6% rate (previously 31%). The spreading eased the tax burden on lower income Americans and increased the tax contribution from the wealthier segments of society.

The following Republican Administration under Bush II eroded the progressivity of the federal tax system once again. They voted to lower the tax rate for both wealthier Americans and for the poorer segments of society. The bottom rate was reduced to 10% from 15% and the top rate was reduced to 35% from 39.6%. Although all taxpayers received some sort of rate reduction, wealthier Americans benefitted disproportionately due to the dramatic increase in their disposable income.

At the end of the Bush Administration in 2007–2008, the world entered a downward economic spiral. Few would doubt that the Great Recession was due to out-of-control, unregulated speculation by the wealthier segments of society. Speculation created an unsustainable boom during the early part of the decade. The ‘bust’ part of the cycle was so severe that entire countries were driven into bankruptcy. Recall that the nation never experienced an economic downturn of this magnitude during the half of the 20th century that featured a highly progressive federal tax system.

Was this economic disaster an historical anomaly due to unusual economic circumstances? Or did standard economic models predict this global catastrophe? Both Keynes and Friedman did indeed foresee that the American economy would risk substantial recession when government forgets about the ultimate importance of a healthy consuming public.

The conservative economic plan that followed the Reaganomics model was ostensibly designed to ‘reform and simplify’ the tax system. In actuality, this approach to ‘tax reform’ actually undermined the economic health of the both Keynes’ and Friedman’s all-important consumer. Minimizing the progressivity of the American tax system freed funds for reckless speculation that fueled a preventable economic meltdown. Further the reduction in progressivity clearly resulted in dramatically diminished tax revenues, which led to a frayed social safety net and rising national debt.

Ultimately, President Obama employed Friedman’s monetary policy to pull the world economy out of its 2007–08 financial nosedive. Instead of creating myriad social programs, Obama merely provided the banking system with an enormous amount of money to generate cash flow. Some liberal economists criticize President Obama for single-mindedly implementing Friedman’s approach to money supply. They faulted his Administration for ignoring Keynes’ call for government programs designed to put Americans back to work rebuilding the national infrastructure. In so doing, the economic recovery has been uneven at best. Investment bankers and Big Business have recovered very nicely from the last recession, while the American working class has seen far more mixed results.

In his second term in office, the Obama Administration reintroduced a modicum of progressivity back into the US tax system. Legislation entitled the American Taxpayer Relief Act of 2012 raised the number of tax brackets to 7 and allowed the top tax percentage to return to 39.6%, the Clinton era tax percentage.

This is the current tax structure. It is still a far cry from the 24 tax brackets of the 40s, 50s, 60s and 70s with the top tax rate of 70% applied only to annual income over one million dollars. However, the current situation is far more progressive than the Reagan Administration with 2 tax brackets and a top tax rate of 28% applied to income over $60K.

A Call to restore Progressivity to the US Tax System

The Obama Administration’s response to the deep economic recession of the Bush Era relied on the economic wisdom of every administration that preceded the Reagan tax revolution. Every presidency since 1933, other than the Reagan/Bush terms, embraced a progressive approach to federal income taxation. For instance, the Roosevelt, Truman, Eisenhower and Kennedy Administrations utilized a notion of progressivity that distributed taxes relatively evenly over a minimum of 24 brackets. All of these administrations agreed that it was reasonable to establish the threshold for the top bracket at would currently be 1 million US dollars. Further, they all agreed to tax the income that exceeded this threshold at roughly an 80% rate.

An extremely progressive approach was a key component of America’s economic health during this period. This half-century presented several dramatic challenges, including both the long recovery from the Great Depression and the costs of the US military effort during WWII. Progressive taxation was also instrumental in our post war economic recovery and was also a prominent feature of the robust economic growth of the Eisenhower/Kennedy years. These 40 consecutive years of progressive taxation produced record levels of economic growth. It is this empirical knowledge that informed the Obama Administration when they decided to increase progressive taxation.

A more progressive federal tax system is often opposed on the grounds that increased taxes on wealthy Americans will somehow undermine investments that would result in job creation or expansion. The history of the American economy from 1932 to 1980 empirically demonstrates that high tax rates on wealthier citizens coincided with a period of enormous economic growth. Clearly, substantially higher tax rates did not preclude an unparalleled period of job creation in American history. Therefore, opposition to progressive taxation based upon the fear of a reduction in job producing investments is historically unfounded.

Without a return to a more progressive tax system, the gap between the rich and poor in America is destined to grow. This growing disparity threatens the future health of our economy. A spokesperson for Standard & Poor Financial Services and the head of the Federal Reserve Board have both warned that increasing income disparity threatens the economic recovery. A 2014 analysis by S&P’s rating agency suggests that: “the widening gap between the wealthiest Americans and everyone else has made the economy more prone to boom-bust cycles and slowed the 5-year-old recovery from the recession.” Due to this finding, the prestigious S&P reduced the rate at which they estimated the US economy would grow over the next 5 years.

Federal Reserve Chairman Janet Yellen recognizes the danger of this growing income gap and suggests government action to address it. “Government policies can help reduce the [income] gap through spending on social safety net programs and education, which help increase economic mobility.” An improved government safety net will certainly soften the impact of the dangerous boom-bust cycle. Improved educational opportunities will certainly enhance the ‘economic mobility’ of the lower economic classes. Yet these two types of government programs by themselves cannot solve the growing income disparity. As both Keynes and Friedman would agree, a high degree of progressive taxation must be part of any sensible approach to addressing dangerous income gaps.

This difference between the rate of economic progress at the top and bottom is really at the heart of the growing income disparity. Regardless of how effectively the programs suggested by Yellen may be, they do not address this accelerating rate. As previously mentioned, progressive taxation effectively addresses this accelerating rate of growth by reallocating funds to government programs that benefit far larger percentages of the population.

Not only does this strategy mitigate the boom-bust cycle by draining off funds employed for potentially reckless speculation, but it also protects the purchasing power of lower and middle-income individuals. Recall that these individuals are the ones most vulnerable to economic down turns. It is also the spending of these individuals that is critical to any meaningful recovery when the economy enters the ‘bust’ part of the cycle.

A Proposal to increase the Progressivity of the US Tax System

Increasing the progressive nature of our tax system need not affect wage earners in the bottom half of the income ladder at all. In fact, their tax contribution could be reduced without reducing federal income. The method is simple. Return to tried and true precedents. Create more tax brackets and spread them out with the design of tapping into the funds of those at the top of the income ladder. Recall that these funds are surplus in the sense that they are not employed for basic necessities. Indeed these funds are potentially harmful in that they can fuel unbridled speculation, which intensifies the dangerous boom-bust cycle.

The following table represents a theoretical progressive tax structure that reduces the tax contribution of everyone except those earning over a million dollars a year. Those in the top income brackets would not even notice the reduction in take-home pay. Further under this plan, the impact on government revenues could be negligible.

One stunning reality of the current approach to taxation is that so many Americans are grouped into the very top tax brackets. For instance, the top bracket would seem as if it should be reserved for the wealthiest Americans. And yet, individuals who would clearly be characterized by any reasonable measure as upper middle income Americans are grouped with those making millions or even tens of millions of dollars annually.

By including upper middle-income earners in this top bracket, the Reagan tax revolution has undermined progressive taxation by mischaracterizing these individuals as part of the wealthy class. Only since the Reagan era has the threshold of the top tax bracket fallen below one million dollars in inflation-adjusted income (2014 dollars). Thus many Americans have been encouraged to oppose increases on the top tax brackets because they have been politically defined as members, or near members, of the wealthiest economic class. Returning to a progressive standard where the upper brackets are reserved for the truly wealthy would reverse this negative perception regarding tax increases.

In addition, notice how artificial and irregular the current tax brackets are. In a truly progressive system, the range of the brackets should increase as the income increases to spread the tax contribution among those with a greater ability to pay. The tax percentage applied to each bracket should rise gradually to ease the burden on those with the least ability to pay. Instead the current brackets start at 10% and then jump irregularly (5%, then 10%, 3%, 5%, 2%, and then 5%). The pattern of progressivity has been undermined by a haphazard creation of tax brackets and is biased towards those with the highest income. It is evident that the current bracket organization stifles the potential progressivity of the system.

The following table contrasts the difference in take-home pay of the proposed versus the current tax structure. Notice under the proposed tax structure that all individuals whose income is under one million dollars take home an extra thousand dollars or more annually. Only those earning over a million dollars a year take home less.

We can’t imagine that this modest reduction in income would impact the ability of these millionaires to buy necessities or to invest in new businesses that create jobs. It might, however, reduce their speculative investments in pursuit of ever-higher profits that have the adverse effect of inflating ‘boom’ bubbles that must inevitably burst. In contrast, the extra money for those in the lower tax brackets would most likely be spent on deferred necessities. This tax rebate could also fund small level luxuries, such as going out to eat, new clothes, a ‘new’ used car, or a modest vacation. All of these expenditures fuel the capitalist economy in a more stable manner, while continuing to generate ever greater wealth for entrepreneurs.

In summary, progressive taxation is a win-win economic situation for nearly everyone. This fiscal approach most equitably provides the funds that support our nation’s infrastructure. This investment in the public sector creates and repairs the vital transportation and communication networks that enable the efficient transfer of goods and services. Investment in infrastructure also provides essential public services, such as water, waste disposal, and energy distribution. Of course, funding the infrastructure is a collaborative effort between federal, state and local governments as well as private investors. But when it comes to the federal share of this critical investment in the national welfare, could a regressive or flat tax system better meet these enormous social needs? We think not.

In addition, progressive taxation is the most equitable and practical approach to provide the social safety net for the American public. Relying upon government programs as insurance against economic hardship, whether individual or societal, cushions the citizen from an otherwise harsh reality. There are times when individual citizens cannot be expected to solve, by themselves, certain crises such as medical adversity, job loss and national disasters. Supporting citizens through government assistance in times of economic crisis is an enlightened form of economic pragmatism. The pre-eminent economists Keynes and Friedman understood that supporting the economic well being of the working class is essential to a stable and growing capitalist economy.

This most practical of economic approaches clearly benefits those at the top of America’s income ladder. A strong consumer base both fuels the profits of the entrepreneurial sector of society and mitigates the devastating effects of the boom-bust cycle. Progressive taxation, in addition to its infrastructure and safety net advantages, also redirects funds away from potentially reckless speculation that frequently leads to the excessive downturns associated with an extreme boom-bust cycle. It is salutatory for wealthy Americans to remember that deep economic recessions not only affect lower income America, but also destroy fortunes. Enlightened self-interest would suggest that increasing the tax responsibility of the wealthy also better protects their investments.

In addition to these positive economic effects, progressive taxation has a positive emotional or moral component as well. This type of tax system exhibits a sense of social responsibility. Those who prosper economically have not done so in a cultural vacuum. The investments and contributions of fellow citizens and prior generations should not be underestimated. Even as great a thinker as Isaac Newton made it clear that his contributions were made while standing on the ‘shoulders of giants’.

The production of wealth is intimately tied to the stability and health of society. Taxes in the name of national defense protect the United States from the destabilizing effects of external aggression. Further, the investments that society has, and continues to make, also create the conditions that enable modern businesses to thrive. The prosperity of the entrepreneurial and professional classes in American society are inextricably linked to a healthy, well-educated labor force. Investors reap substantial profits as a result of a healthy economic culture that goes far beyond the notion of a ‘self-made man’.

It is only fitting that those who prosper the most should make a tax contribution to the Federal Government that is in proportion to their financial success. Historical and contemporary America has enabled their privileged position of affluence. The sort of myopia that leads certain successful individuals to believe that their achievements are due solely to personal talent and effort seems dramatically misguided. When we forget that our individual efforts occur within a context that includes the efforts of other individuals, both past and present, we lose our appreciation for the value of a community network.

If it appears that a primary purpose of government is to obsessively protect the wealth of the upper classes, then trust and faith in government is compromised. If on the other hand, the citizens perceive that a primary purpose of government is to protect the vulnerable and provide an infrastructure that promotes the opportunity of the many, then trust and faith in government is enhanced. When a society creates a tax system that funds its needs by focusing upon an individual’s ability to pay, the citizenry is more likely to perceive that their government is representative of a compassionate community.

This could be why scientific studies are beginning to find a positive correlation between progressive taxation and a citizen’s reported sense of wellbeing. Other studies report that progressive taxation is positively linked to citizen satisfaction with public services, such as education and transportation. It is easy to imagine that an individual’s sense of wellbeing is intrinsically connected to how equitably the tax system funds government social programs.

It may be a lot to ask to reverse the Reagan ‘tax revolution’ in one big step towards restoration of truly progressive tax brackets. A return to progressivity may require many smaller steps. One such step would be to at least eliminate the regressive nature of our tax system.

For more articles on this topic, check out A Call for Tax Justice.